- 8. júla 2025

- Bookkeeping

What Is A Stability Sheet And The Way Do You Learn One?

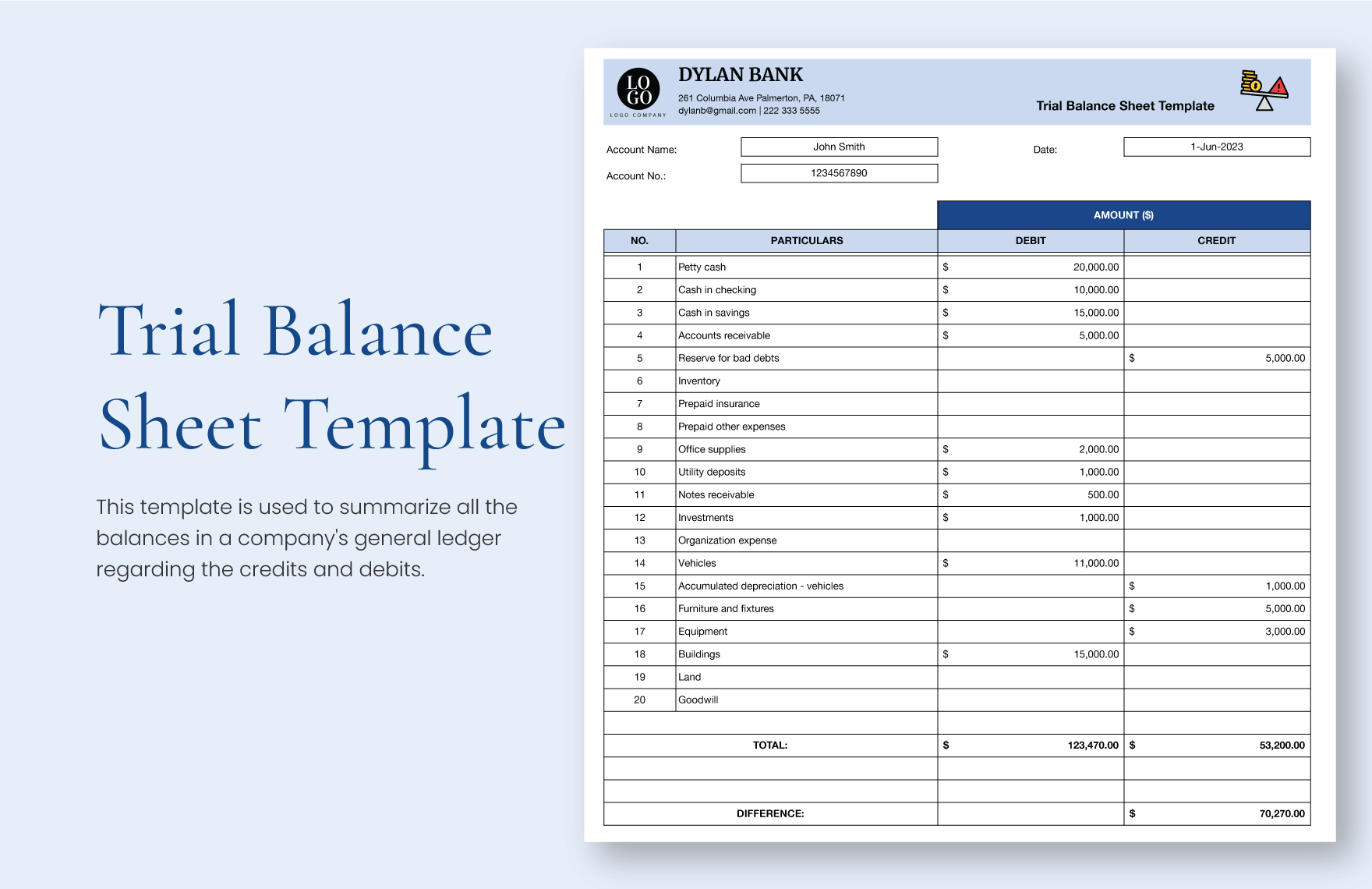

This asset section is damaged into present property and non-current assets, and every of those classes is broken into extra specific accounts. A temporary evaluation of Apple’s belongings reveals that their money on hand decreased barely, yet their non-current property elevated. A steadiness sheet is a monetary statement that gives a snapshot of a company https://www.simple-accounting.org/‚s assets, liabilities, and shareholder fairness at a selected point in time. At a very basic degree, you presumably can report assets and liabilities in a spreadsheet or a notebook, and then use the accounting equation to find out your equity.

Creditors can use the Statement of Monetary Place info to make informed choices about lending terms and interest rates. Equity, also called shareholders’ equity or owner’s equity, signifies the residual interest in a company’s property after deducting liabilities. It signifies the possession claim that shareholders have within the firm. The assets listed on the stability sheet ought to all the time equal the sum of the liabilities plus owner’s equity. If it doesn’t stability the explanations might include incorrect or missing information.

What Is Included Within The Balance Sheet?

Some such assets embrace cash and money equivalents, stock, and so forth. When it’s time to file taxes or meet regulatory necessities, you might want to supply your balance sheet. Even if it’s not required, a stability sheet provides you the data you have to fill out varieties accurately and avoid pricey mistakes. If you’re applying for a loan or line of credit, lenders will likely ask to see your stability sheet. They use it to see whether your business is financially sound and if you’re an excellent candidate for a loan.

Earnings statements delineate a company’s income sources and expenditures inside a defined interval, illustrating the transformation of gross revenue into internet income. If you’ve ever looked at your balance sheet and questioned, “Is stock actually a present… That truck will present up as an asset on the highest of your stability sheet, whereas the mortgage you took out to buy the truck will be shown as a liability at the backside.

If you add up all the belongings, that quantity is the same as when you add up all the liabilities and fairness. With a agency understanding of the steadiness sheet basics, you need to use this report back to information monetary decision-making in your small business. Though it takes time and effort to create an accurate balance sheet from scratch, it is a very important report you as a business owner ought to have. These financial statements are additionally key for calculating charges of return in your traders and for evaluating the capital construction of your corporation, each of that are important processes. Corporations also use steadiness sheets to judge operational effectivity.

Firms usually put together this steadiness on the end of every reporting period. For occasion, a company with strong assets and regular fairness progress may be seen as an attractive funding opportunity. On the opposite, a company burdened with excessive debt or declining fairness may increase considerations about its long-term viability. Companies value long-term liabilities as a outcome of they can symbolize lucrative investments. For example, your organization might take on a long-term legal responsibility by purchasing an organization constructing and incurring a mortgage loan that might be paid off over the next 15 years.

For traders and monetary lovers, a solid grasp of the balance sheet is not only helpful, it’s essential. A balance sheet is a financial report that summarizes the financial state of a enterprise at a cut-off date. It offers an overview of the worth of a business’s property, liabilities, and owner’s equity. This is essential to analyze as a outcome of it signifies that the steadiness sheet was calculated correctly. It is the best method to tell if your company’s finances have been accurately accounted for and that you’re not lacking any liabilities or property.

#1 – Assets

These may help put the numbers on a steadiness sheet into context, make it easier to check the monetary well being of different companies, and see how a company’s well being has modified over time. The shareholders’ equity part consists of the amounts paid into the firm by shareholders in change for shares within the business, as nicely as any earnings retained in the business. It also subtracts out any amounts paid to purchase shares again from shareholders. Frequent ones embody mortgages, student loans, automobile payments and bank card bills. This line merchandise consists of the entire company’s intangible fastened assets, which can or is most likely not identifiable. Identifiable intangible assets embody patents, licenses, and secret formulation.

- Liquidity ratios, corresponding to the current ratio and fast ratio, assess a company’s capacity to fulfill short-term obligations.

- Though it takes time and effort to create an correct balance sheet from scratch, it is a important report you as a enterprise owner ought to have.

- It additionally subtracts out any quantities paid to purchase shares back from shareholders.

- Shareholder’s equity, also known as proprietor’s fairness, refers to a company’s net worth.

- Analyzing all of the stories collectively will let you better understand the monetary well being of your company.

Belongings = Liabilities + Equity

Preserving observe of all of your property and liabilities might seem like a frightening task. But hiring using accounting software will make it easier to calculate and forecast money circulate. Yes, accounts receivable are sometimes included on a company’s steadiness sheet as a present asset. As a general rule, larger current ratios indicate a lower danger that the enterprise will run out of cash.

So, whereas they can’t clarify commercial tendencies, you possibly can examine balance sheets to measure development over time. On the surface, stability sheets seem like an administrative obligation companies have to satisfy. On closer inspection, these types work with balance sheet software to gauge general monetary performance.

As long as you understand two of the numbers, you can calculate the other number. The stock steadiness sheet is also known as the Statement of Monetary Place. Extra detailed definitions can be found in accounting textbooks or from an accounting skilled. You can find particulars about an organization’s debt in its quarterly report (10Q) and annual report (10K). It ought to embrace particulars like when the debt is due and the way high the interest rate on the debt is. Stock markets are unstable and might fluctuate significantly in response to company, trade, political, regulatory, market, or economic developments.